Why and How To Avoid Probate in California

Often, one of the most important estate planning issues for a client is how their property will be distributed after they die. Probate is a court proceeding that clears title to property from the decedent (the person who died) to those named in the decedent’s will (the beneficiaries). Many people hear the advice, “Avoid probate in California” without any further explanation of the reasons why. Let’s unpack the “why.”

Probate is costly

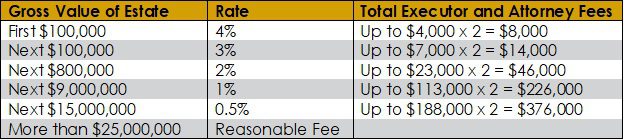

Probate fees in California are based on the total gross value of the estate at the time of the individual’s passing, without considering any debts the deceased owes. These fees are set and governed by state law. Once determined, the probate fee may be paid out twice — first to the attorney and then to the executor or administrator of the estate, unless they choose to forgo their fee.

Moreover, any additional tasks required during the probate process, such as legal disputes or the sale of property, can incur extra charges for both the attorney and the executor. These fees can be substantial, adding to the already significant court costs and other related expenses, which could amount to thousands of dollars.

As previously noted, California’s statutory probate fees permit both the executor and the attorney to receive a portion of the estate’s gross value as compensation. Although the executor has the option to waive their fee, attorney fees are generally mandatory. The following table demonstrates how these fees are calculated and offers examples of potential charges for both executors and attorneys.

For example, if a mother owned a house with title taken in her name in California with a fair market value of $1,500,000 with a mortgage of $800,000 at the time of her death, the probate fees will be calculated based upon the entire $1.5 million property value, despite the estate only having $700,000 in equity.

To transfer the real property to her children at death in accordance with their mother’s will, the children will need to go through the probate process to change the title and take ownership of the home. Assuming the real property is the only property in the mother’s estate, a $1.5 million estate will result in a minimum probate fee of $28,000 and could be as high as $56,000 if the executor elects to take a fee.

Either the children or the mother’s estate would need to raise a considerable amount of money to complete the transfer. In addition, extraordinary fees may be due for selling the house if the children are forced to sell the real property to pay for the fees associated with the probate of their mother’s estate or if the children prefer to receive proceeds from the home rather than the real property.

In contrast, if the mother had established a revocable trust for the purposes of holding the title to the property, her estate could have avoided the probate process and the fees associated with probate.

Probate is time-consuming

The average length of a probate proceeding in California is between 9 and 24 months. During this time, the beneficiaries of the estate do not have legal title to the assets they ultimately are to inherit, and simple tasks involving property become unnecessarily cumbersome. For instance, refinancing a loan or selling the property may require court approval, resulting in additional delays (and additional costs).

There are privacy Issues

Since all documents relating to the property transfer must be filed with the court, the documents are available for public review. In most circumstances, the values of the deceased person’s assets are subject to public disclosure through asset inventories required to be filed with the court, as well as the deceased person’s beneficiaries and any conditions on their receipt of the assets set out in the will.

And it’s not just California you need to worry about

An ancillary probate is a process in a state different from where the deceased resided, in cases where they owned real estate. The laws governing real estate transfer upon death are specific to the property’s location. This means if a person living in California owned property in their name in Oklahoma, the property would require an additional probate process in Oklahoma to transfer ownership upon their death, in addition to any probate proceedings happening in California.

Similarly, if a resident of Oklahoma owns a vacation home in California, transferring this property to heirs upon death would necessitate initiating probate proceedings in California, alongside any probate process required in Oklahoma. The need for ancillary probates can significantly increase both the complexity and duration of the probate process and the associated costs due to the requirement for separate proceedings in each state where property is owned.

READ: What Is an Estate Plan?

How can you avoid probate?

Various forms of holding title to property will determine whether an asset is to be “probated.”

1. Revocable living trust

Creating and funding an inter vivos revocable living trust is one way to avoid probate. A revocable living trust provides for private administration outside of the courts, and there are no required statutory fees, which generally allows for the administration of the trust to be more time- and cost-efficient than probate. However, for a revocable living trust to be effective in avoiding probate, the assets must be retitled in the name of the trust before the settlor’s death.

In addition to avoiding probate, a revocable living trust generally sets forth a plan for managing the settlor’s assets upon both incapacity and death. A revocable living trust may often be the most important part of an estate plan.

2. Assets Not Subject to Probate

Certain assets bypass the probate process and transfer directly to beneficiaries upon the owner’s death.

The way assets are titled can classify them as non-probate. Joint tenancy and community property with the right of survivorship are two primary joint ownership structures that circumvent probate. In a joint tenancy, when one owner dies, their share automatically transfers to the remaining owners until it eventually vests in the last surviving owner.

Community property with the right of survivorship automatically transfers to the surviving spouse without going through probate. However, designating assets as joint tenancy or community property with the right of survivorship means these assets do not pass under the deceased’s will or living trust. This approach is generally not recommended for substantial estates due to potential negative implications on taxes and estate planning.

Another way assets can be transferred without probate is through beneficiary designations. Assets like retirement accounts, annuity contracts, or life insurance policies are directly passed to the named beneficiaries upon the account holder’s death, bypassing probate. However, if no beneficiary is designated, these assets may default to the deceased’s estate and become subject to probate.

If you’re a California resident seeking advice on estate planning, our team is here to help. Contact us today to discuss your needs and how we might assist you.