Bear in Mind?

The yield on 10-year treasury notes has risen from 1.47% in June of last year to 2.22% recently, prompting many to wonder if the “inevitable” bear market in high-quality bonds is finally upon us. With interest rates expected to move higher in the coming years, many investors have avoided an allocation to intermediate and long-term bonds due to the inverse relationship between interest rate changes and the price of a bond. The typical Introduction to Finance textbook visually depicts this relationship with a teeter-totter showing how prices go down when yields go up, and vice versa. Perhaps it is the sheer simplicity of this relationship, or at least how it is described by many, that leads investors to make counterproductive tactical shifts within their fixed income portfolios.

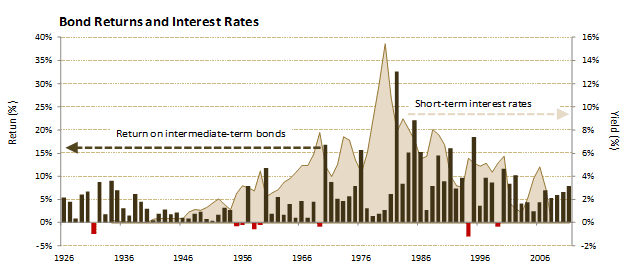

While past performance does not guarantee future results, we offer the following chart, hopefully to provide some peace of mind for fixed income investors. When the term “bear market” is associated with bonds, which are supposed to be the safe part of an investor’s portfolio, the natural reaction is to think about the sharp corrections of 20%+ often experienced in equity markets. However, a bear market in bonds is typically much different and less extreme than a bear market in equities, and that is exactly what the chart below illustrates. The dark brown bars represent the annual returns of intermediate term bonds going back to 1926. The light brown area in the background represents the yield on 3-month Treasury Bills. The first observation is that returns were negative in only eight years since 1926. A second, and perhaps more important observation, is that the scale on the left axis only goes to -5% as the low. For intermediate-term bonds, not only have negative returns been infrequent, they have also been much less severe than what many think of when they hear the term “bear market.” The last observation is that bond returns were still positive as interest rates steadily increased from the 1930’s all the way through the late 1980’s.