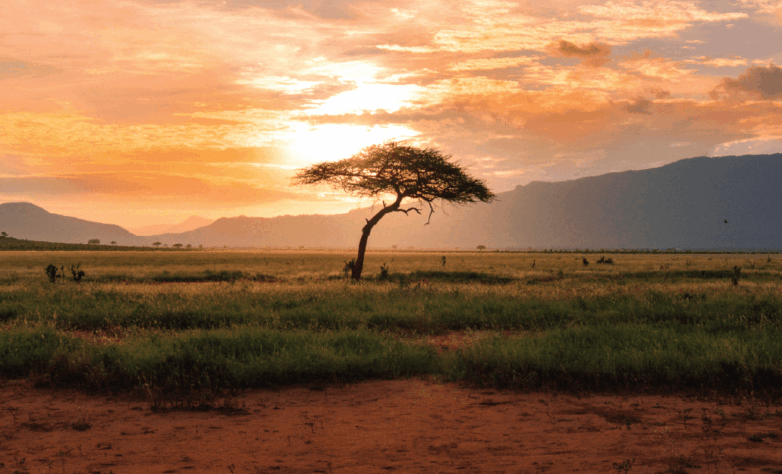

Turning Intentions Into Impact: Kenyan Partners Driving Change

June 12, 2025

|

10:00 am - 11:00 am PT

Join us for a special conversation spotlighting the remarkable organizations behind our Richer Life Foundation partnerships in Kenya.

Watch Now