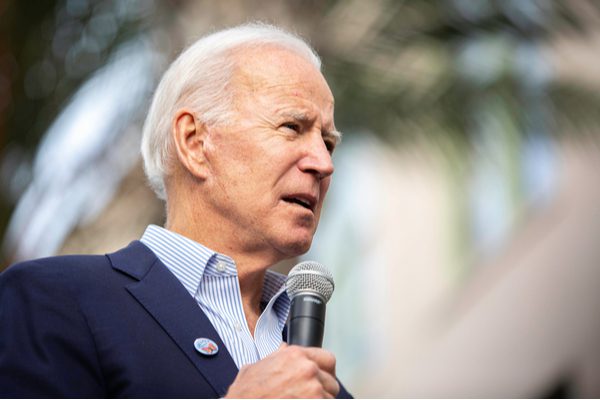

Biden’s Tax Plan: What to Know About Potential Changes

As 2021 approaches, we want to offer some clarity on potential changes to federal tax law. While President-elect Joe Biden’s campaign proposals included several significant tax changes, a divided Congress could stymie his agenda.

The January 5 runoff elections in Georgia will determine the final balance of power in the Senate, with Democrats needing to win both seats to achieve a 50-50 split in the chamber. Even in that scenario, early legislative action may be limited to a new pandemic-related stimulus bill.

In any case, Brighton Jones advisors will continue to monitor developments in Washington and consider the potential impact of any future policy changes in our clients’ planning process. In the meantime, we have endeavored to balance the uncertainty of tax policy in 2021 with the merits of executing specific planning moves in 2020 where appropriate. We aim to pursue this strategy in the weeks to come with the belief that 2021 will provide continued planning opportunities for our clients.

For those interested in an overview of Biden’s tax plan, you can explore this analysis from the nonpartisan Tax Policy Center. The notable proposals include:

- rolling back the income tax reductions of the Tax Cuts and Jobs Act of 2017 for taxpayers with incomes above $400,000;

- taxing capital gains and dividends at the same rate as ordinary income for taxpayers with incomes above $1 million;

- capping the value of itemized deductions to 28 percent for taxpayers with incomes above $400,000;

- subjecting earnings over $400,000 to the Social Security payroll tax; and

- lowering the estate tax exemption to $3.5 million ($7 million for married couples) and increasing the estate tax to 45 percent.

Do you have questions specific to your tax situation? Reach out to our team today.