Inheriting an IRA? Here’s What to Do Next

A stretch IRA is a powerful wealth creator, but there is no universal best action to take on inherited retirement accounts

“When you inherit an IRA, the first rule is, touch nothing,” says Ed Slott, CPA and author of “Parlay Your IRA into a Family Fortune.”

A beneficiary should act prudently to inherit a retirement account properly. As Slott highlights in his book, there are profound and irreversible tax consequences when dealing with the inheritance of an Individual Retirement Account (IRA) or Qualified Retirement Plan (QRP) such as a 401(k). Further complicating the issue, a timely required minimum distribution (RMD) may be needed to avoid a penalty.

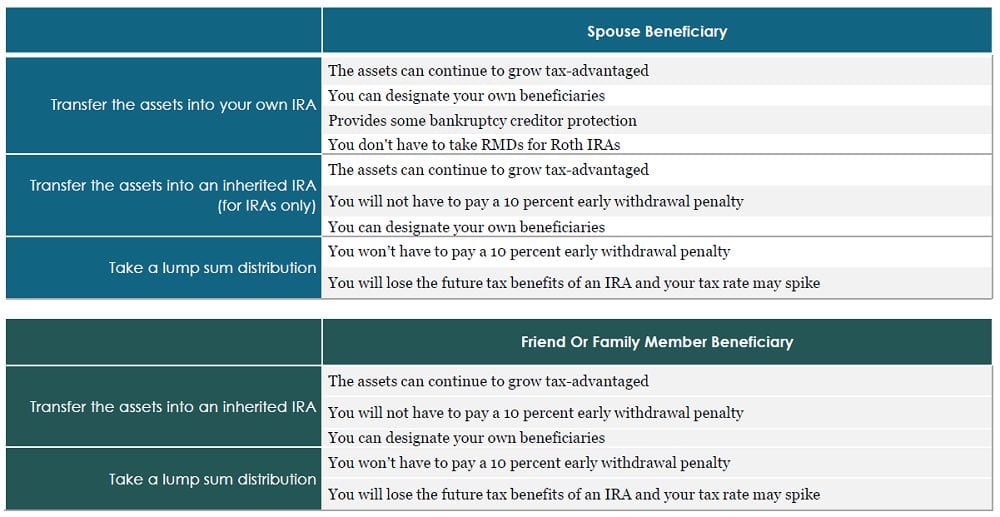

How you elect to inherit your IRA may determine whether you can take a distribution without a penalty. It will also dictate when and how much RMD you will need to take. If you don’t need the money now, there are significant benefits to “stretching” the inherited IRA.

What is a stretch IRA?

Stretching an IRA is the process of extending the tax benefits of the account. All natural person beneficiaries have at least one choice for transferring the original retirement account directly into an IRA. Depending on the circumstance, the original account may be transferred into the beneficiary’s own IRA, an inherited IRA, or either. An inherited IRA retains the benefits of the original retirement account but is subject to immediate lifetime RMDs or a five-year withdrawal election.

All trust beneficiaries of IRAs may also utilize an inherited IRA. However, only qualified trust beneficiaries of QRPs may use an inherited IRA.

The power of compounding makes a compelling case for capturing the benefits of the stretch IRA. Spousal beneficiaries who are considering transferring an IRA into their own IRA should be cognizant that the money will not be available without a 10 percent penalty until age 59½. If a sizable portion of the money is needed before then, the spouse may want to take a lump sum distribution.

Although all beneficiaries are eligible to take an immediate lump sum distribution without incurring a 10 percent penalty, this is typically the least tax-efficient option; all taxes would have to be paid in the current tax year for non-Roth accounts.

Inheriting an IRA: Decision Grid

Other important considerations:

- How old was the account holder? This will determine when and how much you will need to take for your initial RMD.

- Had the account holder taken this year’s RMD? If the account holder had not taken an RMD, you will need to take the RMD by the deadline (generally the end of the current year) to avoid a 50 percent penalty.

The power of the stretch IRA

For younger inheritors, transferring inherited retirement money to an inherited IRA where it can grow tax-advantaged can turn a modest inheritance into a substantial legacy. Consider this hypothetical:

When five-year-old Julie inherited a $50,000 IRA from her grandparents, her parents decided to open an inherited IRA with the money. By doing so, and by limiting Julie’s annual withdrawals to the RMD, they ensured that much of the inheritance would experience tax-advantaged growth for years. If the account earned 8 percent annually and Julie withdraws the RMD each year, her grandparents’ initial $50,000 legacy could turn into a cumulative inheritance of $2,199,000 by the time Julie is 65 years old. That would include $1,373,000 in the IRA and $825,000 in withdrawals.

If withdrawals are reinvested at the same rate of return and a 20 percent tax rate, they would grow from $825,000 to $2,460,000 for a total of $3,834,000. This is the power of the stretch IRA!

This guide covers the basics, but your situation is unique. Contact a Brighton Jones advisor today to make the most of your inherited IRA.