Investor Returns: Chasing the Hot Hand

Mutual fund manager Bruce Berkowitz recently announced that he is closing his Fairholme Fund (FAIRX) to new investors. Berkowitz gained notoriety by performing well through the blow up of the tech bubble in the early 2000’s and subsequently earned Morningstar’s Fund Manager of the Decade award in 2009. After having won the award, retail investors poured into the fund and assets under management swelled to nearly $18 billion. One year later, Berkowitz underperformed the S&P by 35%, resulting in significant redemptions—assets under management have since fallen to $7.6 billion.

Feeling burned by the drastic inflows and outflows of performance chasers, Berkowitz has decided to limit availability to the long-term shareholders who have an appreciation for and understanding of his process. While this move demonstrates prudence on Berkowitz’s part, the story of FAIRX follows that of Bill Miller (Legg Mason) in the book of behavioral missteps for active investors.

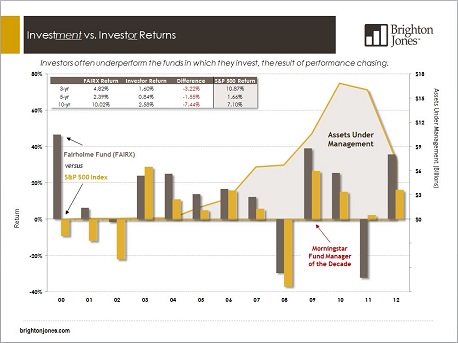

The data below provides an illustration of calendar year returns (bar chart, left axis) of FAIRX and the S&P500 versus assets under management of FAIRX (shaded line graph, right axis). As is generally the case—in the pursuit of superior active management—most investors in this fund completely missed out on the periods of strong relative performance and jumped in just as Berkowitz’s style of investing moved out of favor. The whipsaw effect on investors has been severely damaging: While the fund boasts a 10-year annualized return of 10.02%, the average investor in the fund has gained only 2.58%.

What’s the lesson? Stick with a consistent, long-term strategy, maintain discipline through all market cycles, and recognize that performance chasing all but assures underperformance.