MAGI for Medicare: Tactics to Reduce Premiums

As you approach retirement, many things that were once far in the rearview mirror suddenly show up right behind you. MAGI, or Modified Adjusted Gross Income, is one thing you need to start paying attention to if you want to help lower your Medicare premiums and maximize your retirement benefits.

Defining MAGI for Income-Related Monthly Adjustment Amount (IRMAA)

Premium rates for Medicare programs are based on an individual’s MAGI. And it’s calculated based on your income, tax-exempt interest, and certain deductions. The purpose of the calculation is to assess an individual’s ability to afford Medicare coverage. Higher-income individuals contribute more to their healthcare costs beyond the basic premium schedule. Lower-income individuals may receive more financial support in the form of baseline premiums.

Strategic Income Sources Impact on MAGI for IRMAA

Different income sources can influence your MAGI. Investment income, retirement accounts, and Social Security benefits all have an impact. Let’s examine these sources and how they impact your MAGI for IRMAA:

- Investment Income: Income from investments, such as dividends, interest, or capital gains, is generally included in MAGI calculations. Tracking these earnings is crucial as they can impact your eligibility for tax benefits or government programs.

- Retirement Accounts: Contributions to retirement accounts, such as traditional IRAs or 401(k) plans, are usually tax-deductible. However, funds withdrawn from these accounts are considered taxable income and can increase your MAGI and your Income-Related Monthly Adjustment Amount (IRMAA).

- Social Security Benefits: A portion of Social Security benefits is included in your MAGI. However, the taxable amount depends on your total income, including other sources.

Some sources, like tax-free or tax-deferred options like Roth IRAs or Health Savings Accounts (HSAs), may not be included in your MAGI calculation. A retiree who first draws from a Traditional IRA, then switches to Roth distributions, would exclude the Roth dollars from their MAGI calculation. Qualified medical expenses you pay with a health savings account (HSA) don’t count toward your MAGI. Understanding these distinctions can help you manage your income sources strategically to minimize your MAGI for IRMAA.

The IRMAA surcharge explained

The IRMAA surcharge calculation is based on the MAGI reported on your tax return two years prior. The Social Security Administration uses this to determine if you’ll owe an IRMAA surcharge, with higher MAGI resulting in a higher cost.

Advanced MAGI optimization strategies

By strategically planning your income, investments, and contributions, you can potentially lower your MAGI and reduce Medicare costs. Here are some advanced strategies to manage your modified adjusted gross income for Medicare 2023:

- Timing of income recognition: Managing MAGI effectively may involve deferring or accelerating your income. For instance, timing your retirement account withdrawals or capital gains realizations to fall after a specific tax year could reduce your MAGI for that year.

- Investment Choices: The types of investments and accounts you choose can impact your MAGI and Medicare premiums. Tax-efficient investments and accounts, such as Roth IRAs, may help lower MAGI by minimizing taxable income while still allowing the taxpayer to pull from retirement accounts. In practice, pulling from Roth IRAs is a balancing act. The true benefit of a Roth IRA is tax-free long-term growth. For some investors, selective Roth withdrawals are part of a broader income strategy. Certainly, when you are near the edge of an IRMAA bracket or certain tax thresholds

- Charitable Contributions: Making qualified charitable distributions can reduce MAGI. Donating directly from your retirement accounts via Qualified Charitable Distributions (QCDs) can lower your taxable income and potentially reduce Medicare premiums. While you do not get a charitable deduction for this strategy, it allows you not to recognize the taxable income typically associated with an IRA withdrawal.

These advanced strategies require careful planning and consideration of your individual circumstances. Consulting a financial advisor or tax professional can help navigate these options and make decisions that align with your goals and financial situation.

Managing retirement accounts for MAGI optimization

Traditional retirement accounts, such as a traditional IRA or 401(k), offer tax-deferred contributions. However, withdrawals are generally taxable as ordinary income, potentially increasing your MAGI. Roth retirement accounts, like a Roth IRA or Roth 401(k), offer tax-free withdrawals in retirement. You make Roth account contributions with after-tax dollars, so contributions or withdrawals don’t impact your MAGI.

Utilizing Roth accounts strategically can help manage your taxable income levels in retirement. One strategy is Roth conversions. A Roth conversion involves transferring funds from a traditional IRA or 401 (k) account to a Roth IRA account. Timing is crucial for Roth conversions. You’ll want to convert when your tax bracket is lower or when you have available funds to pay the associated taxes.

IRMAA appeals

Each November, the Social Security Administration sends notices of benefits and any IRMAA adjustments to beneficiaries. Your IRMAA calculations are based on a 2-year lookback. You can also appeal these adjustments if your financial circumstances have changed since then. Think marriage, divorce, retirement, loss of pension income, or the death of a spouse. Yet, the appeal form (SSA-44) requires recipients to outline any reductions in income that have already happened or will occur in the next tax year, and the anticipated effects on future MAGI estimates. At Brighton Jones, we often help clients with the appeal process in these situations, as it can help the Social Security Administration consider information that more closely reflects a client’s current circumstances.

Required Minimum Distributions (RMDs) and MAGI

Once you reach a certain age, typically 73, you must start taking RMDs from your traditional retirement accounts. These distributions are taxable income and can impact your MAGI. Still, understanding the impact of RMDs can help optimize your MAGI and minimize potential tax consequences.

Let’s consider an example. Your required minimum distribution amount adds another $50,000 to your taxable income and MAGI for the year. You may wish to consider using a portion of these dollars to fund qualified charitable distributions. This allows you to essentially “write off” the income from the distribution. Still, if your RMD is smaller, you may still fall within a similar IRMAA bracket, which will not impact your Medicare premium amounts. Each situation is different, and we advise clients to consult with a tax and financial planner to anticipate how healthcare costs will impact their personal financial plans.

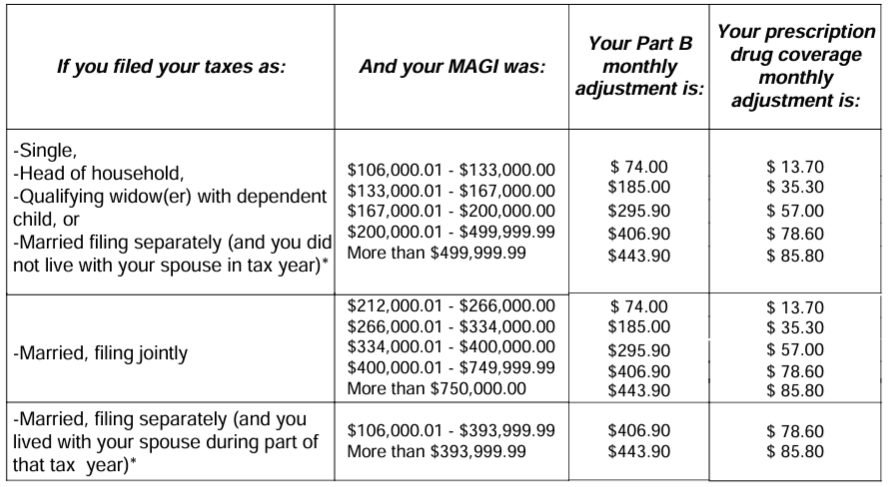

For reference, please see the chart for IRMAA adjustments for 2025 premium amounts (based on 2023 MAGI calculations):

At Brighton Jones, we understand the complexities of retirement planning and can help navigate the intricacies of MAGI optimization. Our team of experts offers personalized guidance tailored to your unique financial situation and goals.

Please remember that past performance does not guarantee future results. Investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product (including those referenced by Brighton Jones, LLC) will be profitable, equal historical performance, prove successful, or be suitable for your individual situation. Market conditions, laws, and regulations change over time, and the views expressed may no longer reflect current positions.

This material is for informational and educational purposes only and should not be construed as personalized investment advice. You should consult with a professional advisor of your choosing regarding the applicability of any issues discussed to your individual circumstances. Brighton Jones, LLC is neither a law firm nor a certified public accounting firm, and no portion of this content should be interpreted as legal or accounting advice.

Scenarios and figures presented are hypothetical and for illustrative purposes only. They are not predictions or guarantees of future outcomes, and actual results will differ. A copy of our current written disclosure statement, which discusses our advisory services and fees, is available upon request.