Trying to Get Ahead of the Next Downturn? Official Recession Announcements Won’t Help

The stock market isn’t the economy. Here’s what investors should consider as the possibility of recession looms.

In response to stubbornly high inflation, the Federal Reserve has indicated it will do whatever it takes to stabilize the prices of goods and services. The primary inflation-fighting tool at the Fed’s disposal is the interest rate it charges to loan money to the nation’s banks.

When the Federal Reserve adjusts the so-called Fed Funds Rate, financial institutions adjust the rates they charge their customers, from businesses borrowing for major projects to home buyers applying for mortgages. In periods of high inflation, the Federal Reserve will increase interest rates, which causes both businesses and consumers to cut back on spending. In turn, this chain reaction is expected to bring down inflation.

So, that’s monetary policy 101. But, it’s far trickier than it sounds for the Federal Reserve to get the interest rate policy right. The challenge lies in raising interest rates enough to bring down inflation, but not so high as to trigger a deep recession. This balancing act is what has investors on edge right now.

In recent conversations with clients, many have asked whether it would make sense to shift portfolios more conservatively given the possibility of a Fed-induced recession.

The problem with this approach is that capital markets are the leading indicator (since the prices of financial securities incorporate, or discount, expectations about the future into current valuations). By the time the National Bureau of Economic Research (NBER) declares the economy to be in recession (based on incoming economic data), markets are likely to be well off their peak already (consider the US stock market is already down 20% from its recent high).

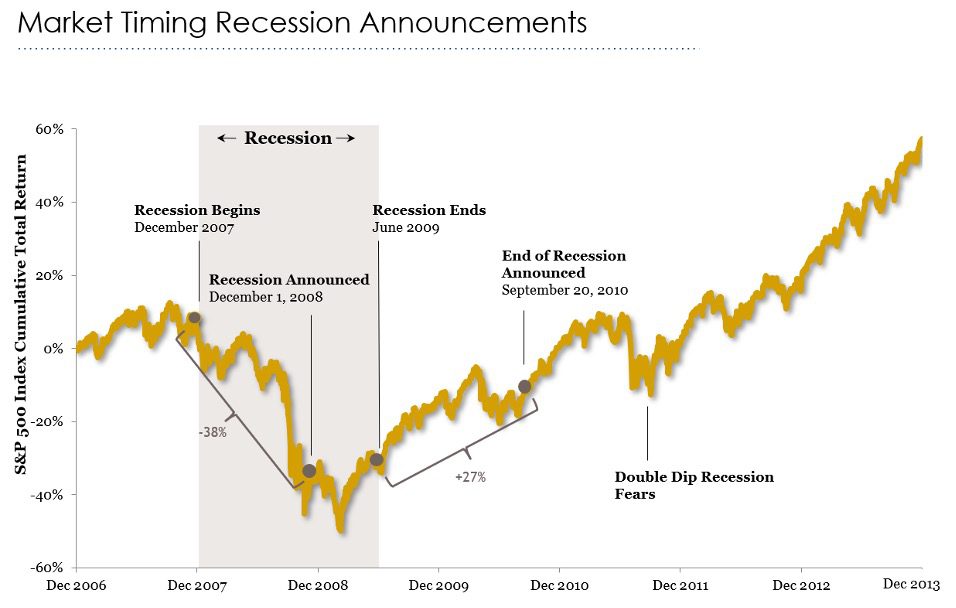

To illustrate, the chart below shows recession start/end dates, recession announcement dates, and the performance of the U.S. stock market from 2007 – 2013:

Key Observations

- On December 1, 2008, NBER announced that the U.S. economy was in a recession that started a year earlier in December 2007.

- The stock market peaked in October 2007, and later declined 38 percent from the official start date of the recession (December 2007) to the date it was eventually announced (December 2008).

- By the time the recession was announced, the stock market suffered most of the losses it would ultimately incur.

- The stock market bottomed out in March 2009, a few months before the recession ended in June 2009, and 18 months before NBER announced the recession had ended.

- The stock market appreciated 27 percent between the end date of the recession and the date it was eventually announced.

- Anecdotally, many observers believed the U.S. was still in a recession as late as 2010 and many feared the recovery was so fragile (based on economic data) that a double-dip recession was highly possible.

Key Takeaways

- Economic activity occurs in real time, but is reported with a lag.

- Investors anticipate what is happening in real time and value financial securities accordingly.

- When economic data is reported, investors compare their earlier forecasts with actual reported data and revise their future forecasts accordingly.

- When earlier forecasts do not align closely with reported results, there tend to be large market swings.

- The prices of financial securities incorporate expectations for thousands of economic variables. There is not a short list of economic variables that, in turn, can be used to reliably predict market movements.

- While the stock market is considered a leading indicator, it is not necessarily correct all the time. Hence, the saying: the stock market has predicted 9 of the last 5 recessions.

- Clients need to be in an allocation they are comfortable with for the long-term. Markets are very fast moving (as the recent pullback demonstrated) and it is not wise to think you can move ahead of it.