How Much Do You Spend? Tips to Manage and Monitor Cash Flow

Have you ever tracked your workouts when working toward a fitness goal? Or perhaps written down everything you ate to embark on a weight-loss program? Most experts agree that in order to improve, we must first track and measure whatever it is we’re trying to improve upon. The same is true when it comes to spending. Whether you’re retired and need to ensure you’re not outspending your portfolio, or still working and want to ramp up your savings, the ability to understand your cash flow is essential knowledge.

So how is one supposed to do this? There are many methods, all with varying levels of detail. For some, simply evaluating the total dollars spent in any given year is all they need, and that is where we usually begin with our clients. For others, understanding specific spending patterns sorted by multiple sub-categories is required.

“Portfolio Paycheck”

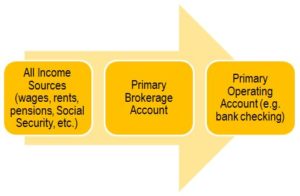

If you’re primarily interested in answering the question of “How much do I spend?” vs. “What do I spend my money on?”, this is the best method. The graphic below illustrates the flow of this approach:

The beauty of this approach lies in its simplicity. At the end of the year, simply sum up the total withdrawals from the brokerage account, and you now have your total spend for the year. As long as your brokerage account serves as the exclusive conduit for your cash needs, it’s foolproof. Although this method won’t give you the specifics of your spending, for many it’s enough to simply know what their total spend is. If your spend is more than it should be, or if you want to better understand the specifics of your spend, there are many options available to you:

Excel – Microsoft Excel offers a number of free budget templates to help people better categorize income and expenses and track results. Although this option requires a substantial time commitment, you’ll get a very clear sense for where your money is going, which categories comprise the lion’s share of your spending, and what your net cash flow looks like at the end of the year.

Although Excel is a powerful tool (and used by this article’s author!), there are a whole host of desktop, web-based and app-based solutions for those who want to leverage technology to track their spending. Here are just a handful options available to you:

Quicken – This desktop-based solution has been around for many years and is still one of the best budgeting tools around. It also helps you categorize your spending, track bills, and set financial goals.

Mint.com – This free web-based solution provides many of the same features as Quicken (it’s actually owned by Intuit, the parent company of Quicken), but also aggregates all of your assets/liabilities into user-friendly reports and graphs. It’s excellent, but the primary downside is the same as most “free” services – they make revenue in other ways by providing targeted advertising and service offerings based on your data.

Level Money – This app (currently for iOS and coming soon for Android) acts as a “spending meter” – on the first of each month, it fills up with your estimated income based on your previous history and then subtracts your fixed costs. Whatever is left shows up in the gauge as money that can be spent. The founders wanted something “that was the digital equivalent of opening up your wallet and seeing how much you have left.”

You Need a Budget – This is both a desktop application and a phone app. The idea behind its method is to “give every dollar a job.” This app is better for people who are OK with some manual entry and want to spend a chunk of time going over their spending every week. For those who use it, the majority are almost evangelical in their praise for the application. It’s free for 34 days and then costs $60.

These are just a handful of the many methods available to those who want to understand their cash flow. Whether you choose the “portfolio paycheck” method or instead choose to embrace some of the technology outlined above, you will benefit from both the process itself and the results your diligence helps reveal.