Tax Loss Harvesting Rules

Tax loss harvesting is a savvy strategy for optimizing your investment portfolio while minimizing tax liability. It involves strategically selling investments that have declined in value to offset capital gains, potentially reducing your overall tax bill.

What is tax loss harvesting?

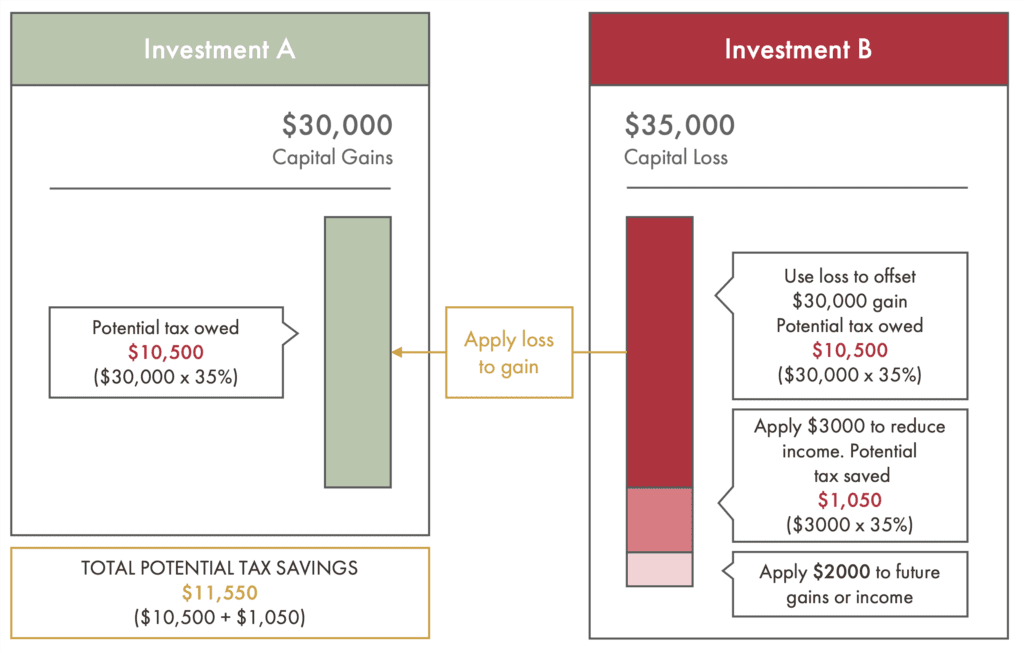

Let’s start with a hypothetical scenario. You purchased specific stock a year ago, and this investment has appreciated significantly, yielding a capital gain of $30,000. Let’s call this Investment A. At the same time, you sold other shares for a short-term capital loss of $35,000. Let’s call this investment B.

Tax loss harvesting involves taking the losses of Investment B to offset the capital gains from Investment A — thereby reducing your tax liability. Your $35,000 loss would offset the $30,000 gain from Investment A, meaning you’d owe no taxes on the gain.

Additionally, you are entitled to write off up to $3,000 in net losses annually ($1,500 if married and filing separately). The leftover $2,000 loss could be carried forward to offset income in future tax years. Assuming you’re subject to a 35% marginal tax rate, the overall tax benefit of harvesting those losses could be as much as $8,050. Let’s take a look at how this works.

This strategy allows you to maintain your exposure to the market while managing your tax burden.

Tax loss harvesting rules

1: Be mindful of wash sale rule

One critical rule to remember is the IRS’s wash sale rule. This rule prohibits you from selling a security at a loss and repurchasing the same or substantially identical security within 30 days of the sale. If you violate this rule, you won’t be able to claim the loss for tax purposes. To comply with the wash sale rule, you can either wait at least 31 days before repurchasing the same security or consider investing in a similar but not substantially identical asset to maintain your market exposure while avoiding the wash sale restriction.

2: Distinguish between short-term and long-term holdings

The tax treatment of capital gains depends on the holding period of your investments. Short-term capital gains, which result from assets held for one year or less, are taxed at a higher rate than long-term capital gains, which apply to assets held for more than one year. To optimize your tax savings, offset short-term gains with short-term losses and long-term gains with long-term losses.

3: Maintain an eye on your portfolio

Review your investments regularly to identify opportunities to harvest losses. Market conditions can change rapidly, so proactively managing your portfolio can help you maximize your opportunities.

4: Consider your investment goals

Align your investment goals with your risk tolerance. Don’t sacrifice your long-term investment strategy solely for short-term tax benefits. Assess the impact on your portfolio’s diversification and performance — volatile markets are challenging.

When should I sell stocks for tax loss harvesting?

Timing is crucial. You should consider this strategy when you have realized capital gains and hold investments at a loss. Remember: you can act throughout the year, not just during tax season. One approach is periodically reviewing your portfolio and identifying opportunities to harvest losses. You can also implement tax loss harvesting during market downturns, as this is when investment losses are more likely to occur. The key is to balance optimizing your taxes and maintaining a well-diversified portfolio.

How do I do this effectively?

Consider the following steps:

- Assess Your Portfolio: Regularly review your investment portfolio to identify securities with unrealized losses.

- Understand Tax Rules: Familiarize yourself with tax regulations, such as wash-sale rules, which prohibit buying the same or substantially identical securities within 30 days of selling them at a loss.

- Prioritize High-Cost Basis Holdings: Sell investments with the highest cost basis to maximize tax savings.

- Maintain Investment Objectives: Ensure alignment with your long-term investment goals and risk tolerance.

- Stay Informed: Stay current with changes in tax laws and seek advice from a financial advisor or tax professional.

When is tax loss harvesting worth it?

There are situations where tax loss harvesting may not be the right path. If you don’t have any capital gains to offset, there aren’t any immediate tax benefits to reap — you are better off holding onto your investments and waiting for future gains.

Then there is the time horizon. If your investment strategy is focused on long-term goals, you may not see an upside in selling assets purely for tax purposes. Tax loss harvesting tends to be more suitable for investors with shorter investment horizons or those actively managing their portfolios.

It’s also important to be aware of the IRS’s wash-sale rules, which prohibit repurchasing the same or substantially identical security within 30 days of selling it at a loss. Violating these rules can nullify the strategy’s tax benefit

Whether tax loss harvesting is worth it depends on your unique financial situation and investment goals. Those in higher tax brackets tend to benefit the most, as the potential tax savings increase with your marginal tax rate.

This strategy is often more attractive for short-term investors or those actively managing gains and losses. Long-term investors may prefer to stick with their assets for the potential of future growth.

And there is an opportunity cost. Selling assets to harvest losses means you may miss out on potential gains if the market rebounds. It’s a trade-off between immediate tax benefits and long-term appreciation.

Tax loss harvesting doesn’t directly generate income; it reduces your tax liability and helps preserve more investment returns. The value comes from the taxes you save by offsetting capital gains.

To maximize tax loss harvesting, regularly review your portfolio to identify unrealized losses, sell strategically while following wash-sale rules, and consider reinvesting the tax savings to keep your money working. Consult a financial advisor or tax professional to ensure your approach aligns with your broader financial strategy.

Tax loss harvesting is a valuable tool for investors looking to manage their tax liability while maintaining a well-diversified portfolio. By understanding the basics, assessing your financial situation, and staying informed about tax regulations, you can effectively implement this strategy to potentially enhance your after-tax returns. However, always remember that individual circumstances vary, so seek professional guidance to make informed decisions that align with your financial goals.

This content is provided for informational purposes only and should not be construed as individualized advice. For individualized advice, please consult with your adviser.