The Complete Guide to 529 Plans

Table of Contents

- What is a 529 plan?

- What are the benefits of 529 plans?

- What are the tax benefits of a 529 college savings plan?

- What are 529 college plan rules?

- How do I open a 529 college savings plan?

- How do 529 plans impact college financial aid?

- What are tax-efficient ways to withdraw from a 529 plan?

- Frequently Asked Questions (FAQ)

What is a 529 plan?

A 529 plan is a tax-advantaged savings plan designed to help families save and invest for future education expenses, primarily for college education.

Congress created the 529 college savings plan in 1996 to help families plan for college expenses efficiently. “529” refers to Section 529 of the Internal Revenue Service code created to allow this tax-free college savings program.

States or educational institutions operate these plans under the legal name “Qualified Tuition Program.” 529 instantly became a crucial tool for college savings and quite possibly the best investment you’ll ever make for several reasons.

Contributions to the 529 plan are made with after-tax dollars and the plan’s earnings are exempt from federal income tax.

What are the benefits of 529 plans?

Think of 529 plans as prepaying for college: Participants put money into the 529 plan each month, then withdraw it when they need to pay for college expenses. Benefits of a 529 plan include:

Qualified expenses: Funds from a 529 plan are for qualified higher education expenses and, as of August 2023, may also cover up to $10,000 per year for tuition at elementary or secondary public, private, or religious schools.

Flexibility: The beneficiary of a 529 plan can be changed to another qualifying family member if the original beneficiary decides not to pursue higher education or has leftover funds after completing their education.

State-specific plans: All U.S. states and the District of Columbia provide their own 529 plans, each with unique investment options and tax benefits, offering the flexibility to choose any state’s plan. In contrast, potential extra tax advantages exist for in-state residents.

High contribution limits: 529 plans often allow significant contributions, depending on the state and plan type. Parents, grandparents, relatives can make contributions, or even the beneficiary themselves.

No income restrictions: 529 plans allow contributions without income restrictions, but non-qualified withdrawals may be subject to income tax and a 10% federal tax penalty on earnings

Your 529 college savings plan can cover much more than tuition. You can withdraw the funds to pay for room and board, textbooks, and other university fees.

What are the tax benefits of a 529 college savings plan?

529 contributions are after-tax dollars. The plan’s earnings are exempt from federal income tax and, in most cases, state income tax, as long as distributions pay for qualified educational expenses.

Tax-free growth: Any investment earnings or capital gains within the plan are not subject to federal income tax as long as the withdrawals pay for qualified education expenses.

Tax-free withdrawals: When you withdraw money from a 529 plan, the earnings portion of the withdrawal is not subject to federal income tax. This tax-free status applies if the expenses are for eligible educational costs, such as tuition, fees, books, supplies, and certain room and board expenses.

State tax benefits: Many states offer additional tax incentives for their residents who contribute to their state’s 529 plan. These benefits may include state income tax deductions or credits for contributions made to the plan, reducing the individual’s state tax liability.

Gifting benefits: For estate planning purposes, 529 plans offer an opportunity to contribute significantly to a beneficiary without incurring gift taxes. The Tax Cuts and Jobs Act of 2017 increased the annual gift tax exclusion, allowing individuals to contribute up to the annual gift tax exclusion amount without triggering gift tax consequences. (As of August 2023, this is $17,000; $34,000 per married couple.)

What are 529 college saving plan rules?

Qualified education expenses: 529 plan funds can only be used for qualified education expenses, including tuition, fees, books, supplies, and certain room and board costs at eligible higher education institutions. The Tax Cuts and Jobs Act of 2017 expanded 529 funds to include up to $10,000 per year per beneficiary for elementary or secondary public, private, or religious school tuition.

Contribution limits: Each state’s 529 plan sets its maximum contribution limits, which can be substantial, sometimes reaching hundreds of thousands of dollars or more per beneficiary. However, contributions must not exceed the cost of the beneficiary’s qualified education expenses.

No federal income tax deduction for contributions: Contributions to a 529 plan are not federally tax-deductible. However, they offer tax-free growth on earnings and tax-free withdrawals for qualified education expenses.

Tax treatment of non-qualified withdrawals: If you withdraw money from a 529 plan for non-qualified expenses, the earnings portion of the withdrawal is subject to federal income tax, along with a 10% federal tax penalty on the earnings. The original contributions are not subject to these penalties.

Beneficiary changes: Account owners can change the designated beneficiary of a 529 plan. For example, if the original beneficiary decides not to pursue higher education, the funds can be transferred to another eligible family member, such as a sibling or first cousin.

Rollovers between plans: It is possible to rollover funds from one 529 plan to another 529 plan for the same beneficiary without incurring taxes or penalties. However, rollovers can only happen once every 12 months.

Age limits for contributions and distributions: While there are no age restrictions for 529 plan beneficiaries, some plans may have age limits for contributions, typically around the beneficiary’s 30th birthday. Additionally, funds must be used for qualified education expenses before the beneficiary turns 30 to avoid tax penalties on non-qualified withdrawals.

Impact on financial aid: 529 plans are an asset of the account owner (usually a parent), not the beneficiary when determining financial assistance eligibility. This means that the plan may have a smaller impact on financial aid than assets owned by the student.

How do I open a 529 college savings plan?

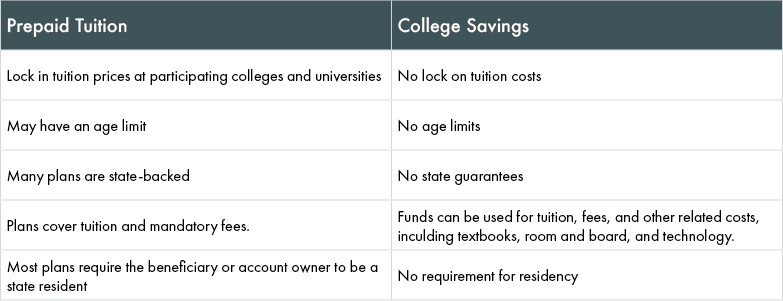

There are two types of 529 plans: prepaid tuition and savings plans.

Anyone can open a 529 college savings plan. You can set anyone as the beneficiary—a friend, son, daughter, grandchild, or yourself. No income restrictions limit who can open, contribute, or benefit from a 529 plan. And there are no limits to the number of plans you can set up.

Judging the tuition trends of the past three decades, experts estimate that a four-year degree from a public school will cost upward of $205,000 by 2030.

However, plans do have limits as to how much you can contribute. Contributions cannot be more than the educational expenses of the beneficiary. If others are fueling the fund besides yourself, you may have to pay gift taxes if someone contributes more than $17,000 in a year (or $34,000 from a married couple).

You can front-load five years of gifts into 529 plans and must file the proper documents with the IRS stating this front-loading.

How do 529 plans impact college financial aid?

Saving for college in your child’s name may impact financial aid based on need by increasing your EFC, or Expected Family Contribution (EFC), which is the expected amount a family would pay toward a cost of a college education each year.

The federal government determines EFC and eligibility for Pell Grants and Direct Loans. About 400 colleges, professional schools, and scholarship programs use the Institutional Method (IM) to award need-based aid based on a different calculation of EFC.

Applying for aid based on the IM requires families to submit the College Service Scholarship Profile, which requires more information than the Free Application for Federal Student Aid or FAFSA.

The EFC determined by the federal government and IM may significantly differ, with the EFC determined by the federal government generally being lower for more affluent families.

Deadlines vary among colleges and states, and some awards are given on a first come/first serve basis, which is also an important factor to consider.

What are tax-efficient ways to withdraw from a 529 plan?

Use the funds for qualified education expenses: The primary way to ensure tax efficiency when withdrawing from a 529 plan is to use the funds for qualified education expenses. These expenses include tuition, fees, books, supplies, and certain room and board costs at eligible higher education institutions. When withdrawals are used for qualified education expenses, the earnings portion of the withdrawal is tax-free at the federal level.

Avoid non-qualified withdrawals: If you withdraw money from a 529 plan for non-qualified expenses, the earnings portion of the withdrawal is subject to federal income tax, along with a 10% federal tax penalty on the earnings. To maintain tax efficiency, only use the funds for eligible educational costs.

Coordinate with other education tax credits and deductions: If you are eligible for education-related tax credits or deductions, such as the American Opportunity Credit or the Lifetime Learning Credit, consider how they interact with your 529 plan withdrawals. Sometimes, it might be more beneficial to use these credits first and tap into the 529 plan funds later.

Control the timing of withdrawals: Consider the timing to align with the expenses incurred. Spreading the withdrawals over time can help manage your tax liability if you have multiple years of qualified education expenses.

Combine 529 plans for multiple beneficiaries: If you have multiple 529 plans for different beneficiaries, consider consolidating them into one. This can simplify record-keeping and make it easier to manage withdrawals strategically.

Understand state tax rules: Be aware of your state’s tax treatment of 529 plan withdrawals. Some states offer additional tax benefits for in-state plan contributions and withdrawals, while others may tax the earnings on non-qualified withdrawals.

Consider partial withdrawals: If you have more in the 529 plan than is needed for immediate qualified education expenses, you can take partial withdrawals to cover only what is required, leaving the remaining funds to continue growing tax-free for future educational needs.

What are 529 college plan withdrawal rules?

When taking money out of your 529 plan, consider withdrawing the maximum amount for tax-free treatment. Even if you plan to withdraw less and spread expenses over multiple years, withdrawing the maximum and making additional contributions later can boost your tax benefits.

Calculate your 529 withdrawals well in advance to give your plan administrator time to process requests within the calendar year.

Be aware of 529 distribution rules to avoid “double dipping” with other tax incentives like the American Opportunity Tax Credit. If planning to use these credits, factor them into your withdrawal strategy.

Direct payment to the college simplifies 529 distributions, but check the college’s policy first. To prevent reductions in need-based grants, request the distribution be payable to you or your child.

For off-campus students, ensure room and board expenses align with the university’s official cost of attendance.

Students with a disability before age 26 can transfer funds penalty-free to an ABLE account.

Know 529 withdrawal rules to maximize tax benefits. Unused funds can be utilized for various purposes, such as changing beneficiaries or making student loan repayments.

Experts estimate that a four-year degree from a public school will continue to soar because of the past three decades’ tuition trends. According to data from the U.S. Federal Reserve System, student loan balances are already sitting at an all-time high of $1.744 trillion as of Q1 2023. At this rate, starting a 529 college savings plan might not just be your child’s best chance at a college education—for many students, it will be their only chance.

Talk to one of our advisors to find out more about your 529 college funding options so you can start planning for your child’s future. Remember, saving now reduces borrowing later. You (and your child) will appreciate the foresight.