Talk of Tariffs and Trade Wars Abound. What Is It All About?

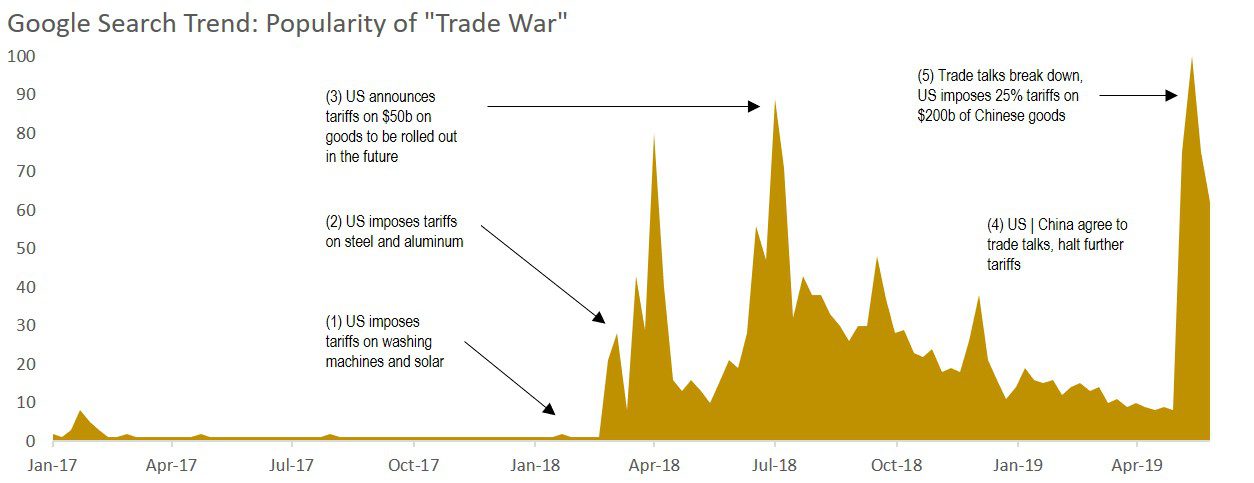

If it seems as though you have heard more about tariffs and a trade war in the past year than ever before, you may not be mistaken.

With ongoing trade negotiations breaking down between the United States and China in early May, an endless stream of commentary has been written about the possibility and potential impact of an all-out trade war between the world’s two largest economies.

In this commentary, we provide background on the trade dispute between the United States and China, review global equity performance since negotiations broke down last month, and describe how our portfolios are positioned to weather potential market volatility.

The U.S.-China Trade Dispute, Explained

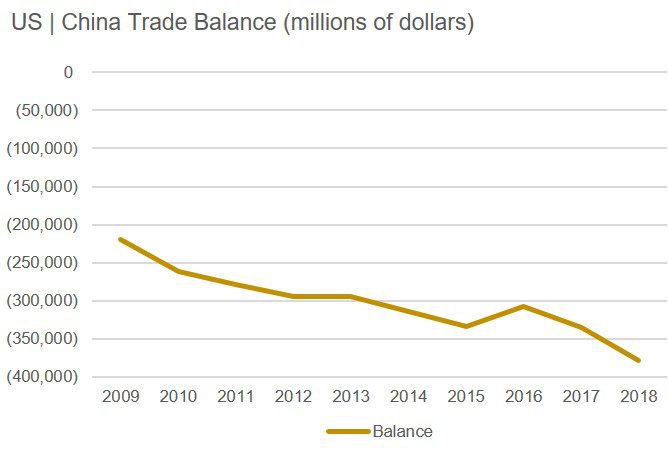

President Trump has long accused China of perpetrating one of the “greatest thefts in the history of the world” when it comes to trade with the United States. What President Trump is referring to is the annual trade balance between the two countries.

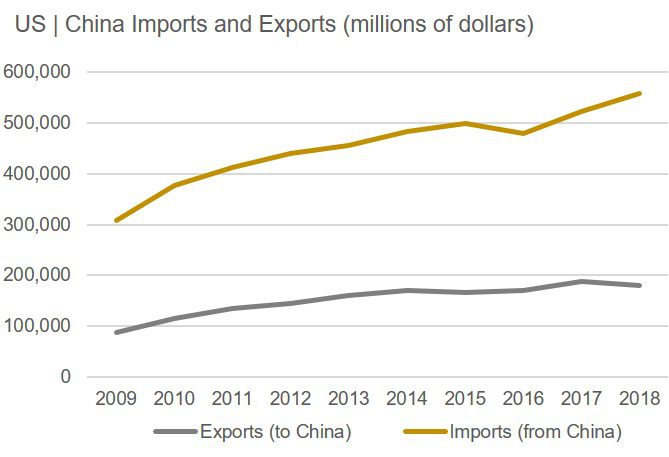

As illustrated below, the United States imported nearly $560 billion worth of Chinese goods and services in 2018, but China imported only about $180 billion of American goods and services. This left the United States with a trade deficit of about $380 billion with China last year—a number that has steadily grown year after year.

Source: Bureau of Economic Analysis, U.S. Census, Brighton Jones

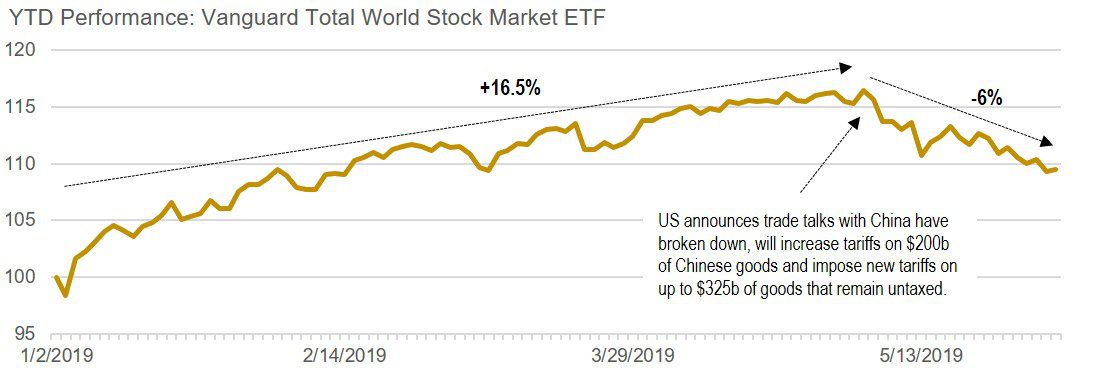

In his 2016 bid for the White House, President Trump vowed to strike a more balanced trade relationship with China. And, as of late April, all signs were pointing to a likely agreement within weeks. Then, on May 5, much to the surprise of observers around the world, President Trump tweeted that the United States would be increasing tariffs on $200 billion of Chinese goods from 10 percent to 25 percent and would be looking to impose new tariffs on $325 billion of additional goods that are currently untaxed.

As illustrated in the chart below, the market reaction has been negative, with global equities suffering a ~6 percent decline over the past month (of course, a decline of this magnitude is well within our range of expectations in a given year).

So, why have trade negotiations been so challenging? In our view, it has less to do with the economics of China simply buying more American goods and services, and more to do with ideological differences pertaining to the role of government.

China offers substantial government guidance, resources, and regulatory support to Chinese industries while limiting market access for imported goods, foreign manufacturers, and foreign service providers. Furthermore, Chinese government officials typically condition market access on a foreign enterprise’s agreement to transfer technology, conduct research and development in China, or make valuable, deal-specific commercial concessions. The principal beneficiaries of these policies are Chinese state-owned enterprises, as well as other favored domestic companies attempting to move up the economic value chain.

Hence, the challenge is that any trade deal that would be acceptable to the Trump administration would require China to fundamentally change how its government involves itself in the affairs of Chinese businesses. While China would likely agree to purchase more American goods and services to help narrow the trade gap, they have no desire to change their “hands on” approach to business.

Given the surge in trade war rhetoric and related market volatility, investors may be tempted to “do something” with their portfolios. But, we continue to believe a balanced approach that considers the anticipated cash needs of our clients is the best way forward:

Aligning Client Allocations With Their Cash Needs

- The key to assuming risk responsibly in pursuit of higher returns is to give each asset class an adequate amount of time to achieve its long-term expected rate of return. This is why we set allocations based on the timing and amounts of each client’s anticipated cash needs.

- We protect the first eight years of anticipated cash needs in a Capital Preservation Portfolio, and the next six years in a High Income Portfolio—which buys us a 15+ year time horizon on monies allocated to Global Equity.

- In cases where our clients do not have any anticipated cash needs for the foreseeable future, our model calls for a minimum allocation of 10 percent to Capital Preservation and 20 percent to High Income—meaning that our most aggressive portfolio currently has 30 percent allocated to fixed income securities (this is the result of changes we made to our investment model in July 2017 to reduce our equity exposure in light of elevated valuations). For comparison, aggressively allocated target date retirement funds will typically allocate 10 percent to fixed income and 90 percent to equities.

Functional Diversification

- If the back and forth tariffs between the United States and China slows economic growth, we expect positions in our Capital Preservation Portfolio to provide positive returns. Typically, interest rates decline when signs of slowing growth emerge, which benefits high-quality fixed income securities.

- If tariffs lead to higher levels of inflation, asset classes such as inflation-protected bonds, global real estate, master limited partnerships, and floating rate bonds may dampen volatility elsewhere in our portfolios (as the returns of these market segments tend to be positively correlated with inflation)

- If the United States and China find compromise and come to an agreement on trade, global equities could retrace recent losses and approach new highs. In our view, any trade deal that de-escalates trade war rhetoric and tariff threats would be beneficial to markets (few are expecting China to fundamentally change its view on the role of government and business).

In short, we believe that our portfolios are appropriately positioned considering potential risks, potential opportunities, and prevailing economic and political conditions.

As always, please do not hesitate to reach out to your planning team with any questions.

Read more from our blog: