Is Now the Time to Sell?

With the Dow Jones Industrial Average posting new all-time highs and with global equity markets having enjoyed a large run-up since the last correction of 10% or more, many investors are wondering whether now would be a good time to take profit. Unfortunately, the answer is not a simple yes or no. The following commentary provides some historical context to market runs (bulls and bears), an update on the recovery of non-US markets, and other considerations you should make when determining whether or not to rebalance:

Time to Sell? Consideration #1:

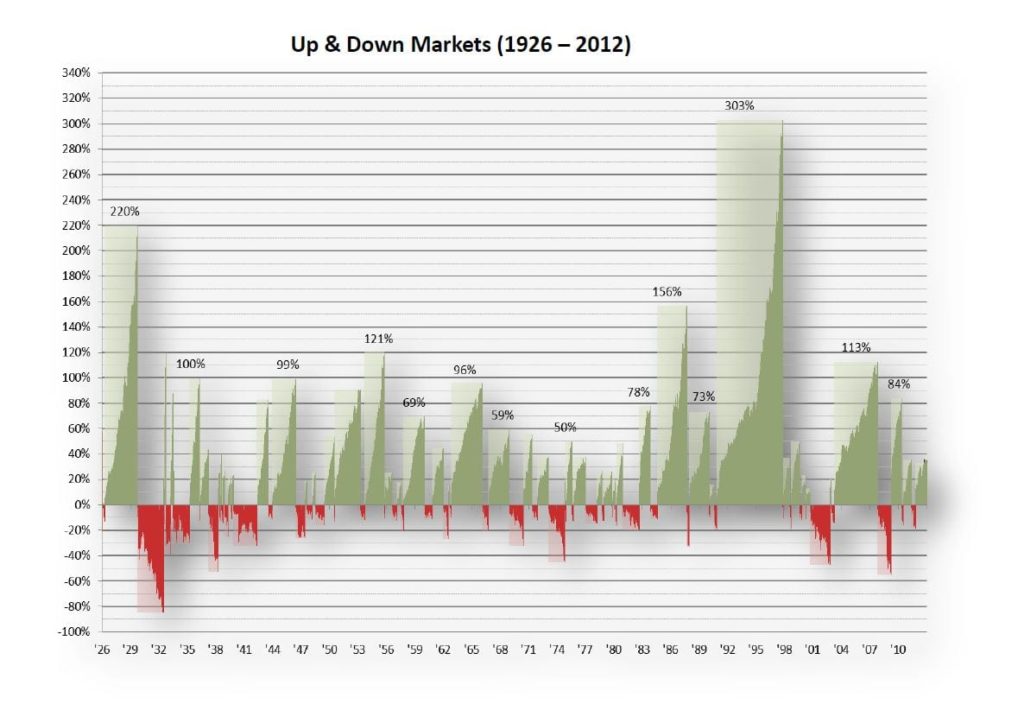

The following chart documents up and down periods for the US stock market from January 1, 1926 through December 31, 2012. A down period is identified when the market experiences a negative daily return followed by a cumulative loss of at least 10%. The down period ends at its low point, which is defined as the most negative cumulative return prior to achieving a positive cumulative return. An up period is defined by data points not considered part of a down period. Once the cycle is established in retrospect, the first day of that cycle resets the performance baseline to zero. The returns do not include dividends.

We can draw a number of lessons from this graph (and its underlying data), including:

- The average up market advanced 58% without the interruption of a 10% or greater pullback.

- The median up market advanced 38% without the interruption of a 10% or greater pullback (a few outliers are pulling the average higher)

- The current run of ~40% is just about equal to the median—meaning that, historically, markets continued higher 50% of the time following a run similar to the current one.

- The last correction technically occurred following the downgrade of US sovereign debt in 2011, however we were close last May with a pullback slightly greater than 9%. The US stock market is about 20% higher since last year’s “almost correction.”

- We often write about the normalcy of equity market volatility and cite the risk of abandoning a well-designed plan in down markets. This data suggests that discipline is just as important in good markets as it is during more volatile times.

Time to Sell? Consideration # 2:

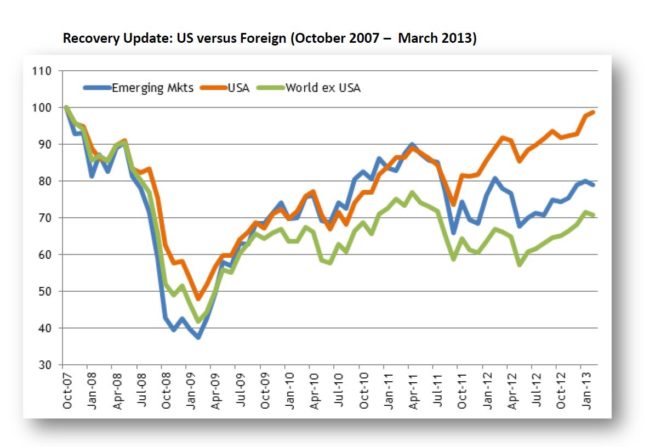

The following chart illustrates that the US stock market has indeed recovered, but foreign developed and emerging markets still have a ways to go until they reach price levels last seen in October 2007. Emerging Markets remain 20% below their high water mark, and foreign developed markets remain 30% below their high water mark. Therefore, investors who are overexposed to the domestic stock market could consider replenishing exposure to foreign markets, which have trailed US stocks for the past few years. The returns do not include dividends.

So Should You Take Profit?

It depends…

- If you have maintained higher-than-preferred levels of risk while waiting to recover from earlier losses, then it would be reasonable to consider replenishing depleted capital preservation holdings at this point in time.

- Let the strategic asset allocation be your primary guide for rebalancing. If domestic stocks are overweight, then take profit and replenish underweight asset classes—same as always.

- Reducing stock exposure in response to the Dow setting new highs is nothing more than an emotional response. The best approaches to investing remove the impact of emotion and are systematic and process driven.