Target Date Funds Could Be Slowing Your Retirement Growth

If you’ve just started your career or recently joined a new company, chances are you’ve set up a retirement account and faced that long, often overwhelming list of investment options. For many, this moment leads to analysis paralysis — and the easiest choice is the preselected Target Date Fund aligned with your expected retirement year. While these funds offer convenience and simplicity, they may not be the best fit for young investors looking to maximize the long-term growth of their retirement nest egg.

What is a target date fund?

Target Date Funds (TDFs) are a type of dynamic allocation strategy. They offer pre-curated investment mixes that automatically adjust over time based on how close you are to retirement. Early on, they lean heavily toward growth-oriented assets, such as global equities (US and foreign stock funds). As you age, the allocation gradually shifts toward more conservative investments, such as bonds and cash equivalents, to reduce volatility and prepare for income needs in retirement.

One of the biggest advantages of TDFs is that they automatically rebalance. This feature can be especially valuable for younger investors who don’t have the time or expertise to manage their own allocations. Even without a maximum growth tilt, the consistency of automatic rebalancing provides structure and discipline.

Sounds great, right?

You might be thinking, “That sounds perfect—a set-it-and-forget-it strategy that evolves with me.” And you’re not wrong. TDFs aim to simplify investing and reduce the need for active management.

But here’s the catch: even the longest-dated TDFs (like 2065 or 2070) typically allocate 8–12% of your portfolio to bonds and cash-like assets that are considered “safe” but offer limited growth potential. Rather than viewing this as something to avoid entirely, it’s helpful to recognize that retirement accounts should primarily be engines of growth. Where you place your conservative investments matters just as much as how much you allocate to them.

Isn’t being conservative with my money a good thing?

It’s a fair question. After all, being cautious with your money sounds like a smart move, especially when it comes to something as important as retirement. But when you’re in your 20s or 30s, playing it too safe in your retirement accounts can work against you. Liquidity needs for big life events — such as buying a first home — may call for keeping some conservative investments. But those funds are often best kept in taxable accounts or savings vehicles rather than in your 401(k). Over the decades, excessive conservatism in retirement accounts could translate into hundreds of thousands of dollars in lost growth.

Equities aren’t all the same either. A thoughtful balance between domestic and foreign equities, paired with a clear target mix and a system for rebalancing (whether self-managed quarterly or through an advisor), creates a stronger long-term foundation.

Target date funds vs. DIY 401(k) allocation

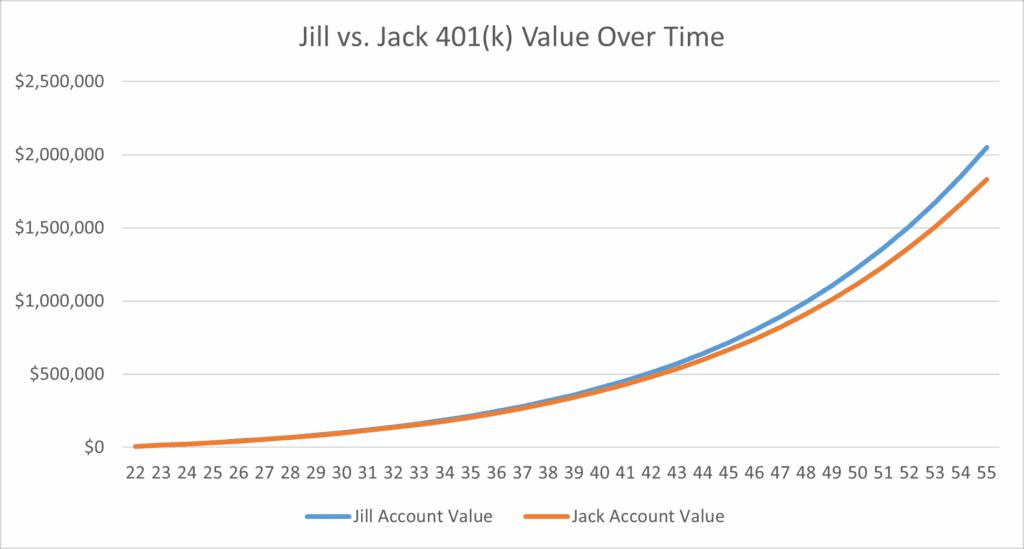

Let’s look at two different people just starting in their careers – Jack and Jill. To keep things fair, we’ll assume Jack and Jill have identical circumstances:

- Both are 22, making $60k per year, and get a 3% annual raise

- Both contribute 7% of their monthly paycheck to their 401(k) while their company contributes 3%

- Both plan to retire at 65

Jack looks at his 401(k) investment options and chooses the 2070 Target Date Fund, while Jill takes a few extra minutes to split her investments between US Equities and Foreign Equities (70%/30%). To keep this projection realistic, let’s assume neither of them touches their accounts until age 55, when it likely makes sense to begin adjusting allocations to prepare for retirement. (In this way, both will be entering the “flight path” toward balancing their portfolio, ready for retirement.) Also, for simplicity, we will assume the Target Date Fund remains at its most aggressive allocation. In reality, it would gradually shift to a more conservative mix, likely widening the performance gap even further.

So, after 33 years of growth, what do Jack and Jill have in their respective 401(k)s?

Jack’s account is worth $1,830,338, and over that same 33 years, Jill’s account has grown to $2,048,938. That’s a $218,600 difference, and all it took was Jill taking a few extra minutes to adjust her investment options in her 401k.

The bottom line

It might be tempting to default to a Target Date Fund. It’s simple, hands-off, and often marketed as a one-size-fits-all solution. But not taking the time to explore your 401(k) options could cost you significantly in the long run. The key isn’t avoiding conservative assets altogether, but being intentional about asset location. Keep long-term growth at the center of your retirement accounts, while placing safety and liquidity in savings or taxable investments where you can actually access them.

A few thoughtful decisions today — whether it’s balancing equity exposure between domestic and foreign markets, setting up regular rebalancing, or working with an advisor — can lead to a much stronger financial future.

About the Author: Sam Murphy, CFP®, is a Lead Advisor at Brighton Jones. He helps high-income professionals and families design tax-efficient investment strategies and retirement plans aligned with their values and long-term goals.

This content is for informational and educational purposes only and should not be construed as individualized advice or a recommendation for any specific product, strategy, or course of action. Brighton Jones, its affiliates, and employees do not provide personalized investment, financial, tax, or legal advice through this communication. This material is not intended to, and does not, create a fiduciary relationship under ERISA or any other applicable law. For individualized advice tailored to your specific circumstances, please consult with your adviser.