Down Market Strategies to Take Advantage of

Global equity markets have sold off in dramatic fashion since the start of the 2nd quarter. The U.S. stock market, as measured by the Vanguard Total Stock Market Index ETF, is approximately 21% below its all-time intra-day high.

While market declines of this magnitude can be unsettling for investors, they are a regular occurrence by historical measures.

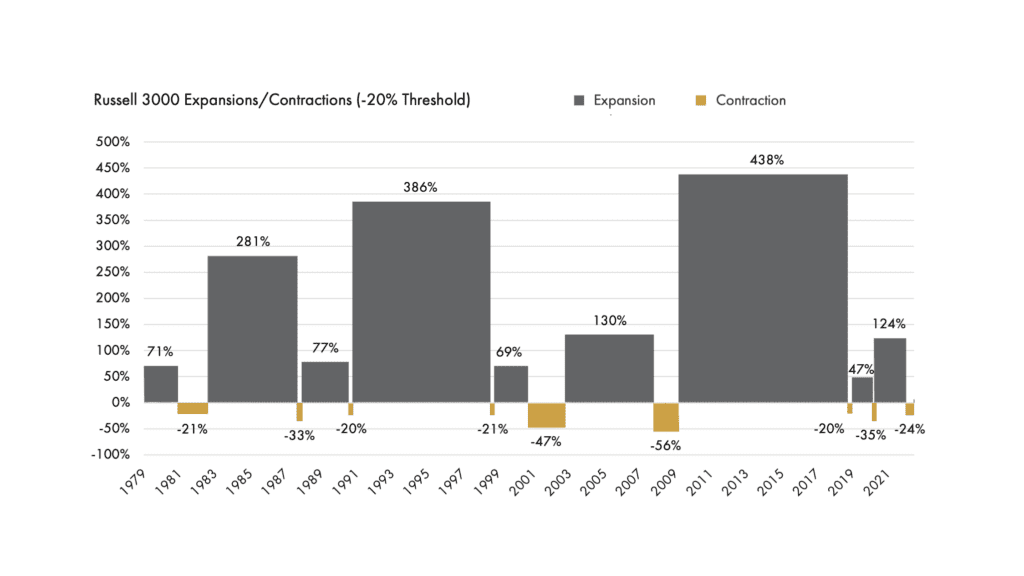

Since 1979, the US Stock Market (as measured by the Russell 3000 Index) has declined by 20% or more on nine separate occasions. And, despite these temporary setbacks, the index has generated an annualized return of nearly 12% over the same period.

Whenever equity markets are in the midst of a pullback, individual investors are often advised to “stay the course.” This is good advice. Investors should not change a strategy they put in place during rational times when an unfavorable outcome they knew was inevitable (i.e., a market decline) eventually comes to pass. Indeed, we similarly advise our clients to “stay the course” when equity market performance turns negative.

While advising clients to stay the course has the potential to come across as dismissive of prevailing or potential risks, we remain confident in giving this advice because of the steps we have already taken to prepare our clients and their portfolios.

Discipline in a bull market can be just as important as discipline in a bear market.

In December of last year our investment team published a paper, How We Are Positioning Portfolios and Why. The paper detailed why we were taking a “moderate conservative” stance towards risk within our portfolios and identified various opportunities we believed could add value in the current environment. Indeed, decisions to reduce overall equity exposure, overweight value stocks, remain committed to foreign markets, and diversify our fixed income exposure have contributed to strong relative performance this year (yes, our international equity is outperforming our domestic equity strategies year-to-date).

Of course, sometimes there’s also value in the actions you don’t take as an investor. As painful as a 20% correction for the total U.S. stock market might feel, many of the trendy market segments, themes, and individual stocks that performed well in prior years have been hit considerably harder, giving up all excess return previously earned. One lesson you might take from our recent blog post about thematic investing is that discipline in a bull market can be just as important as discipline in a bear market. In other words, we are in considerably better shape today for having not piled into overcrowded IPOs and SPACs, Disruptive Technology and Innovation, Cryptocurrency and Blockchain, and speculative growth stocks.

Looking ahead, as chatter about the possibility of a Fed-induced recession begin to make headlines, it’s important to revisit why Recession Announcements Aren’t Useful Market Timing Indicators. This piece is a good reminder that the economy and the stock market are not the same thing, and it’s the stock market that’s the leading indicator (not the other way around).

In addition to our recent commentary, here are a few other timeless articles that discuss various planning opportunities we often consider on a client-by-client basis while markets are down.

Tax Loss Harvesting

The practice of tax loss harvesting involves selling out of positions that are trading at losses while simultaneously buying similar investment strategies in order to maintain comparable asset class exposure.

Booked losses can help mitigate taxes through several factors, including offsetting capital gains you realized (or will realize later) this calendar year.

Learn more about opportunities for tax loss harvesting in Matt Mormino’s article, including what to consider for your specific situation.

Roth Conversions

Market volatility has had an impact on retirement account balances, particularly for those with long-time horizons and more aggressive positioning. But with this sour volatility comes the opportunity to make some lemonade by considering a Roth conversion strategy.

For people who finding themselves in a low income, low tax environment with retirement assets invested in equities, a Roth conversion may be in order.

A Roth conversion allows a traditional retirement account owner to transfer—or “convert”—some or all of their accounts into Roth dollars. Whereas traditional retirement accounts are attractive because they can offer an immediate deduction, and therefore immediate tax benefit, Roth accounts are attractive because they can offer tax-free withdrawals.

Learn more about Roth conversions in another article by Matt Mormino and the advantages that can benefit you.

Dollar-Cost Averaging

If you find yourself holding a sizable cash balance but are reluctant to invest due to ongoing market volatility, consider dollar cost averaging. Dollar cost averaging is employed when an investor purchases a set dollar amount of a security, or group of securities, on a consistent interval—generally monthly or quarterly—over a predefined period (generally less than one year). While it may not be a reliable way to increase your return, it can be a useful tool for helping investors overcome debilitating emotions such as fear and regret.

Learn more about dollar-cost averaging in Brian Tall’s article, including four scenarios and best practices.