For Brighton Jones Clients, Private Investments are a Niche Option No Longer

Private investments, including venture capital, private equity, private debt, and real estate, have long been viewed as the domain of institutional investors. That is quickly changing.

The Explosive Growth of Private Investments

The first private investment funds were created in the 1950s due to regulatory changes in the US and Europe that enabled institutional investors to outsource management to specialized firms. These favorable regulatory events and the evolution of the limited partnership resulted in the growth of a niche, often opaque, corner of the investment world.

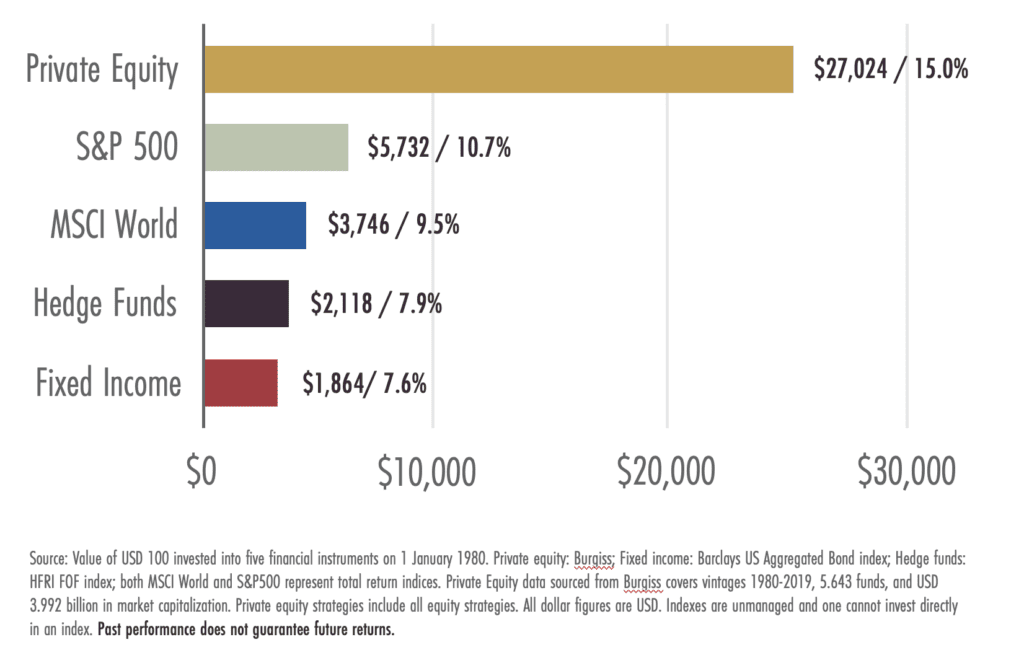

Over time, private investments demonstrated consistently strong performance over public markets and frequently posted a lower decline than public markets during periods of high market volatility. Take, for example, the following hypothetical: a $100 invested in five different asset classes on 1 January 1980 and assuming reinvestment of all proceeds for forty years. As the chart below shows, private investment can be a compelling option.

As demand has grown for investment opportunities to earn returns above public markets and diversify into less correlated asset classes, more capital has been raised in these markets than in public markets each year for over a decade.[1]

“The growth of private markets has accelerated since the financial crisis of 2007-09, outpacing public markets. At its pre-crisis peak, the private-capital industry had some $2.2trn under management. Today it manages four to five times as much, a little over half of it in North America.”– The Economist, Private Markets Have Grown Exponentially (Feb 23, 2022)

Brighton Jones Evolving Expertise in Private Investments

In 2017, after eight years of U.S. equities returning more than 19 percent per year and U.S. high yield bonds returning more than 13 percent per year since March 2009 lows, the investment team at Brighton Jones began to increasingly see attractive private opportunities as public equity valuations became stretched and credit spreads compressed. Ever since, the Brighton Jones Private Investments team has expanded its expertise and access to private opportunities.

In 2018, Brighton Jones acquired a majority stake in Blueprint Capital, a real estate investment trust, giving clients access to private credit opportunities via real estate backed lending. That year also witnessed the launch of a client-centric private fund, Brighton Jones Investment Partners.

A year later, in 2019, Brighton Jones Real Estate Advisory Group launched to help clients manage and maximize the returns of privately held real estate investments while also taking advantage of favorable tax programs, such as Qualified Opportunity Zones and DST 1031 Exchanges.

Since launching these vehicles, the investment team has reviewed hundreds of opportunities and deployed significant capital to build a portfolio of direct and indirect investments, including technology companies, traditional operating companies, and real estate.

A unique aspect of Brighton Jones’ approach is the clients’ role in the process. Clients have sourced many of the opportunities vetted by the fund, which has significantly increased access to special deals. Clients also share their professional expertise and personal networks to help portfolio companies accelerate growth, address complex business challenges, and fill board positions. The collective efforts of clients have enhanced every aspect of Brighton Jones Private Investments offering.

“I am thrilled about our clients’ engagement as they source and vet Private Investments together. Our clients with a passion for Private Investments are pooling their collective experience, learning from each other, and sharing access to deals. This client-centric approach is leading to better investment decisions and ultimately better outcomes.” – Jon Jones, Co-Founder and CEO

The Future is Now – Fully Integrating Private Investments into Financial Plans

In the mid-1980’s Yale hired David Swensen as Chief Investment Officer of the university’s endowment. At the time, the typical institutional fund was invested in a traditional “60/40 portfolio” comprised of 60% domestic equities and 40% bonds. Swensen took principles of modern portfolio theory and pioneered an approach to endowment investing that emphasized diversification and expanded Yale’s portfolio into private investment. A strategy that has since become known as the “Yale Model.” Over the following 36 years, Yale produced an annualized gain of 13.7% per annum, outperforming the average endowment (as measured by Cambridge Associates) by 3.4% per year![2]

Significant outperformance grabs attention, and Swensen’s revolution quickly spread to other endowments and foundations and then to sovereign-wealth and pension funds. It is now the predominant model among institutional investors.

Today, that institutional approach has become broadly available to Brighton Jones clients. Founded on the principle of helping clients manage their entire balance sheet by taking the role of a Personal CFO, over the years, Brighton Jones has adapted to clients’ increasingly sophisticated balance sheets by adding in-house expertise in tax, strategic philanthropy, estate planning, and now with the latest addition to Personal CFO services – the ability to include private investments as a part of full balance sheet management.

“Our private investment team goes above and beyond providing access to private investment opportunities or simply chasing returns. We integrate private investments into the overall financial plan, so clients have confidence that all their investments accrue to their long-term goals. Some clients really enjoy the community as well, which is a huge bonus both for the clients and the companies in our portfolio.” – Tyler Mayfield, Managing Director of Brighton Jones Investment Partners

Private investments, once a niche and opaque investment option, are increasingly popular and becoming an integral part of portfolio construction at Brighton Jones, which now provides several robust private investment offerings that can be fully integrated into a client’s balance sheet.

[1] Morgan Stanley, Public to Private Equity in the United States: A Long-Term Look (Aug. 4, 2020)

[2] YaleNews, David Swensen’s Coda (Oct 22, 2021)