Adding Perspective to the Market Pullback

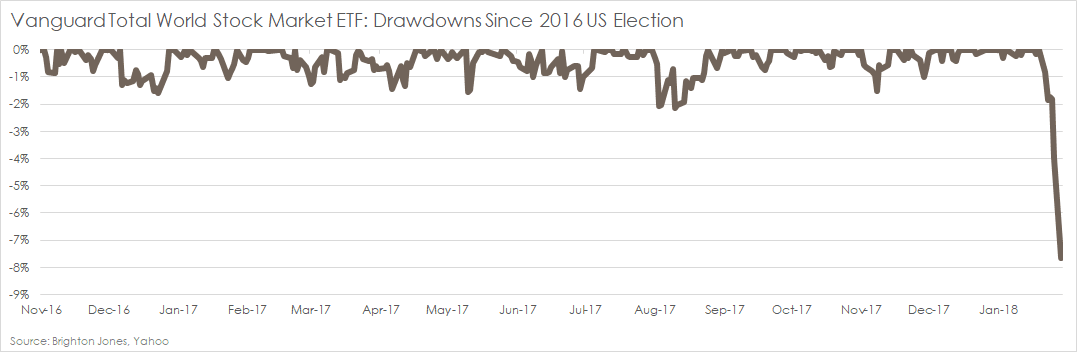

Yesterday, global equity markets suffered their worst one-day percentage decline since August 2011. The Vanguard Total World Stock Market Index ETF declined 3.84%, and has now slid 7.65% since peaking on January 26.

The last time equity markets suffered a one-day decline of greater magnitude, the United States had just been stripped of its AAA credit rating by Standard and Poor’s, concerns about the European Sovereign Debt Crisis spreading from peripheral to core countries were materializing, and many economists placed a non-negligible probability on the global economy slipping back into a recession.

Today, the headlines read much differently than in 2011. Labor markets are healthy, corporate earnings are rising, the United States government just passed the most significant tax reform in 30 years, and major foreign economies are on much stronger footing than a few years ago.

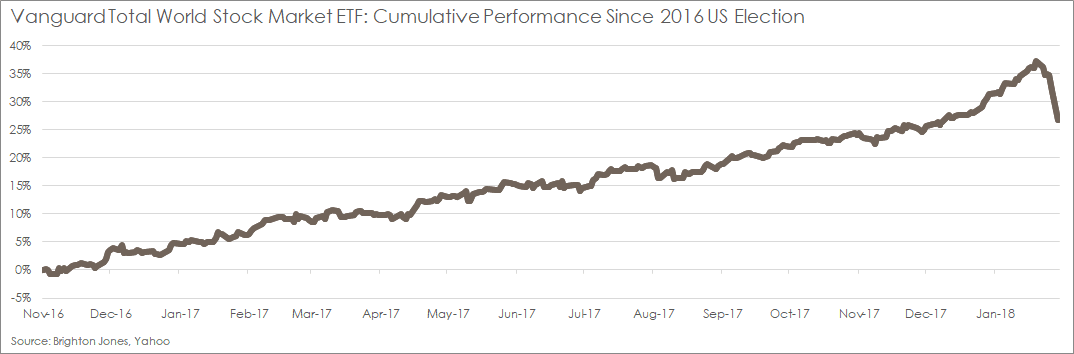

As sharp as the decline has been, the global market is back to where it was only about a month and a half ago.

In the absence of major economic news or earnings announcements yesterday, the sharp sell-off is presumed to reflect a continuation of last week’s renewed concerns that strong economic conditions could potentially breed higher inflation (and therefore higher interest rates). There is also speculation that algorithm-based trading exacerbated yesterday’s sell-off.

While the magnitude of yesterday’s decline is attention-grabbing, it is not uncommon for markets to pull back after extended run-ups. Consider the charts and bullet points below (click on the image to view the larger version):

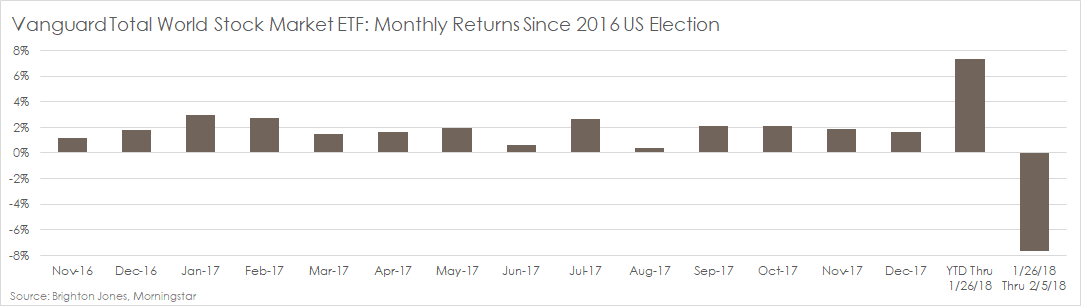

- The global stock market has posted positive returns, averaging more than 2%, every month since the 2016 U.S. election.

- The global stock market was up a staggering 7.4% YTD through January 26.

- As sharp as the six-day decline has been, the global stock market is back to where it was only about a month and a half ago (a reminder of how far and fast markets have risen).

- The global stock market remains 26% higher since the 2016 U.S. election.

- Prior to the past six trading sessions, the global stock market had not endured a pullback in excess of ~2% since the 2016 U.S. election.

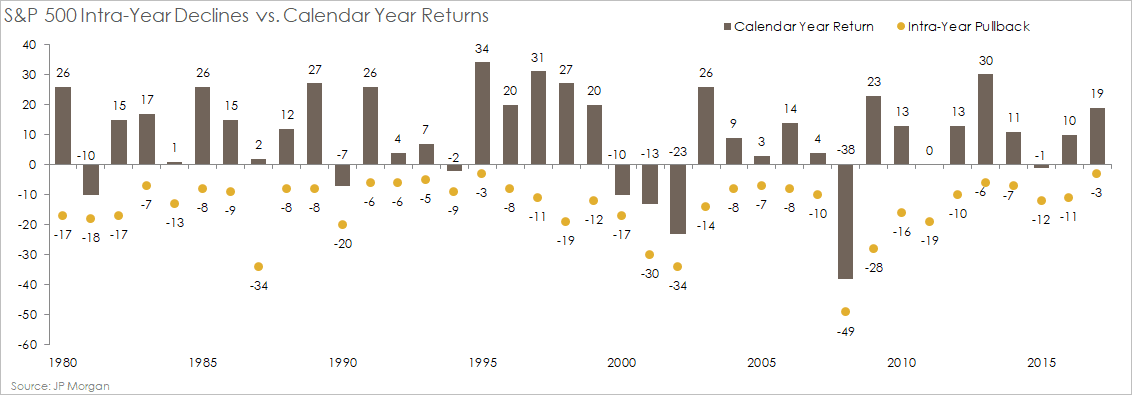

- Dating back to 1980, 1995 was the only other year besides 2017 without at least a 5% pullback.

- The average of intra-year pullbacks has been about 14%.

In terms of investment strategy, we are not recommending any portfolio adjustments at this time.

For those who are concerned about near-term volatility, you can rest easy knowing that your portfolio allocation is structured around your anticipated cash needs. That is, monies needed to fund obligations in the near-term are protected in cash and short-term high-quality bonds (i.e. not exposed to the extreme volatility of equity markets), while the portion of your assets invested in global equity markets has a time horizon of 10-plus years.

For those who might be looking at today’s decline as a buying opportunity, we urge caution and would prefer to wait. A 7-8% pullback is relatively shallow by historical measures. Only after a more pronounced pullback would we potentially look to take advantage of this development.

We will continue to monitor this situation as it unfolds. Please do not hesitate to contact us with any questions.

Read more from our blog: